Mortgage brokers vs banks: What’s the difference?

The difference between banks and mortgage brokers is that banks can only offer their own products, while mortgage brokers can present multiple mortgage options. Independent mortgage brokers are licensed mortgage specialists who have access to multiple lenders and mortgage rates. They essentially negotiate the lowest rate for you, and because they acquire high quantities of mortgage products, mortgage brokers can pass volume discounts directly on to you. Banks, on the other hand, can only offer their own mortgage products.

| Bank | Mortgage Broker | |

|---|---|---|

| Market Share1 | 57% | 43% |

| Description | Chartered banking institution with personal banking, credit card, loan and mortgage services. | Licensed mortgage specialist with access to multiple lenders and mortgage rates. An intermediary whose commission is paid by the lender providing the mortgage product. |

| Lender | Yes | No |

| Puts application together | Yes | Yes |

| Examples | TD, RBC, BMO, CIBC, Scotia, Tangerine | Centum, CanWise Financial, Dominion Lending, Safebridge Financial, The Mortgage Centre |

| Pros | Banks allow you to consolidate your services with a provider you have an ongoing relationship with and have deemed trustworthy. | Mortgage brokers essentially ‘shop’ around, negotiate for you, and present the lowest rate on the market. Volume discounts achieved by mortgage brokers are passed directly to you. Mortgage brokers will find alternative ways to assist with down payment and funding. |

| Cons | Banks can only access and offer you their own rates and products. Banks will regularly give discounts on their posted mortgage rates; however, you are responsible for this negotiation. | Mortgage brokers are a less familiar avenue, and first time home buyers would not have pre-existing relationships with them. Also limited public store front unlike the banks. |

Popularity of banks versus mortgage brokers

According to the 2023 CMHC Mortgage Consumer Survey mortgage brokers represented 43% of total mortgage originations in 2023. This was actually a slight decline from 55% market share in 2022; CMHC attributes the drop to today’s rising interest rate environment, noting that “. Consumers who contracted their mortgage before the rise of interest rates are significantly more satisfied with their overall experience with their broker.” However, over the long term, it’s clear consumers are increasingly finding value working with a mortgage broker, as market share remains higher than it was in 2003 (26%) and in 2009 (40%).

Comparing banks versus mortgage brokers

In addition to the points in the comparison chart above, there are other factors to consider when deciding between a bank and mortgage broker. Banks, for instance, can offer some discounting for consolidating your services with them. The value of this will vary from person to person.

Another key benefit of using a mortgage brokers is that they have access to, and knowledge of, the entire mortgage market. They can advise which lenders will consider your case and which will not based on your individual circumstances. This is particularly useful for people with poor credit ratings. Mortgage brokers have access to lenders who specialize in servicing people with adverse credit, and can leverage relationships with mainstream banks.

Mortgage brokers can also access exclusive deals not available on the open market, or negotiate a better interest rate or lower lender fees from the lender in some cases.

How mortgage brokers finance mortgages

Mortgage brokers will assist you in the application process, from pre-approval to home appraisal; however, it is important to note they are an origination service. A financial institution, not a mortgage broker, will provide and service your loan. The bank or lender will collect payments and provide customer service after the closing; however, you can also reach out to your mortgage broker to help you throughout the life of your mortgage.

Many of the major Canadian banks sell through mortgage brokers, including TD Bank, Scotiabank and CIBC. In a recent survey conducted on our website, we asked our participating mortgage brokers which three lenders they work with the most. The most popular lenders were as follows:

- TD Bank

- Scotia Bank

- Meridian

- First National

- MCAP

- Desjardins

- Home Trust

- ICICI Bank

- Equitable

- Alterna

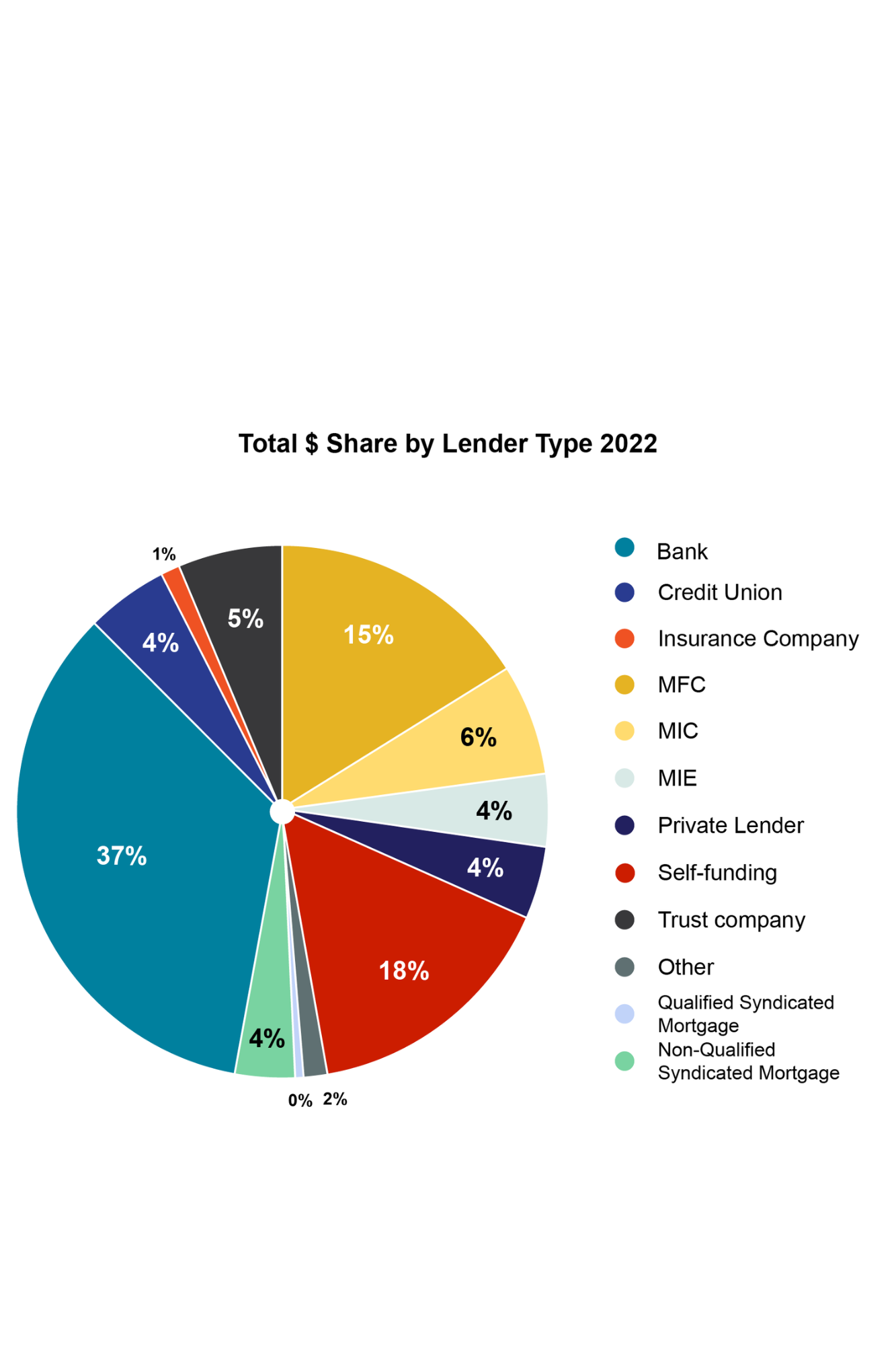

Other lenders

In addition to banks, other financial institutions such as trust companies and credit unions also service mortgages. You can access these rates directly or through a mortgage broker.

In the past, prospective home buyers turned exclusively to their banks for their mortgage needs. Today, you have more options at your disposal with the growing presence of mortgage brokers.

The Office of the Superintendent of Financial Institutions (OSFI) has also adjusted its approach to mortgage renewals, removing the requirement for uninsured borrowers to pass the Minimum Qualifying Rate (stress test) when switching lenders for a straight renewal.

The change is intended to give mortgage borrowers more flexibility in finding competitive renewal options without facing additional qualification hurdles, particularly amid rising mortgage payments.

References and notes

- Canadian Association of Accredited Mortgage Professionals, CAAMP

- Canada Mortgage and Housing Corporation (CMHC) 2023 Consumer Survey

- Canadian Mortgage Trends